Automated Futures Trading for Prop Firm Traders

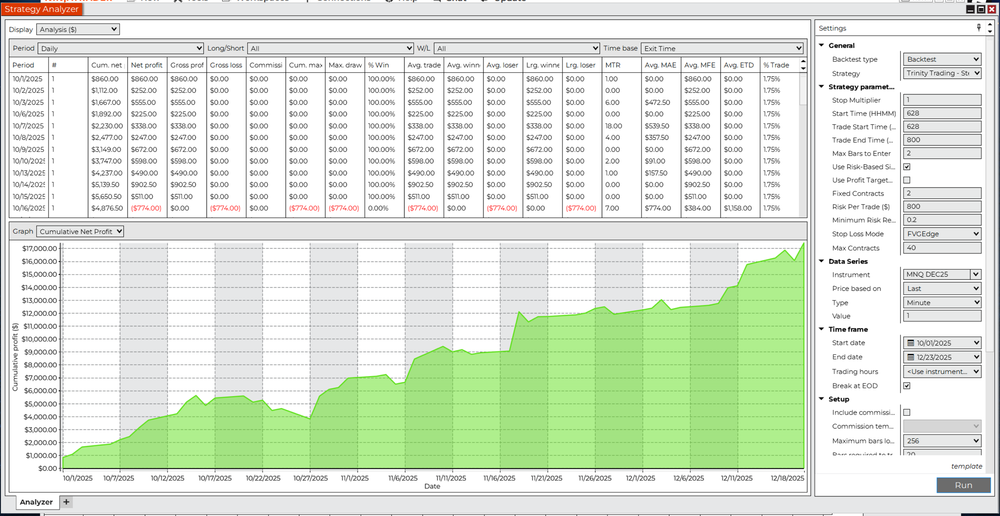

EVALUATION FUNDED PAYOUTS

Automated, rules-first AI trading algorithm built for futures prop firms.

AI TRADES YOUR ACCOUNT. YOU TAKE THE PAYOUT.

AI built to pass prop firm evaluations, then automate execution on your funded account, earning you payouts. Works on any Tradovate-enabled prop firm by leveraging NinjaTrader.

Risk-free for 30 days. The market is hard enough.

Cancel in the first 30 days and get a full refund — your access stays active through the remaining days

Automate the eval → payout process

StealthScalp runs inside NinjaTrader 8 and is built for futures prop firm rules—so your execution stays disciplined, consistent, and hands-free when it matters most.

- Pass faster: rules-first execution with session + EOD safety.

- Manage funded accounts: consistent automation built for long runs.

- Tradovate ready: designed to plug into your Tradovate prop workflow.

StealthScalp

for Tradovate

Why StealthScalp

Most tools help you see the market. StealthScalp helps you execute — so the edge stays in your account, not your subscription.

30-day money-back guarantee

Try it with real data, real workflow, and real constraints. If it’s not for you, cancel within the first 30 days for a full refund — and keep access through the remaining days.

- No overtrading — it only executes when conditions are met.

- No revenge trading — losses don’t trigger emotions, rules stay intact.

- Airtight risk management — sizing, stops, and limits enforced every time.

- Predetermined rules — the same setup, the same execution, every session.

- No hesitation — trades are taken (or not) exactly as designed.

- One job: execution — you decide the rules, the bot follows them.

Better value: lower cost + higher upside — because execution is the hard part.

Compare the approach

StealthScalp

Automation + rules-first execution

$98/mo

Indicator Suite

Information + tools (manual workflow)

$197/mo+

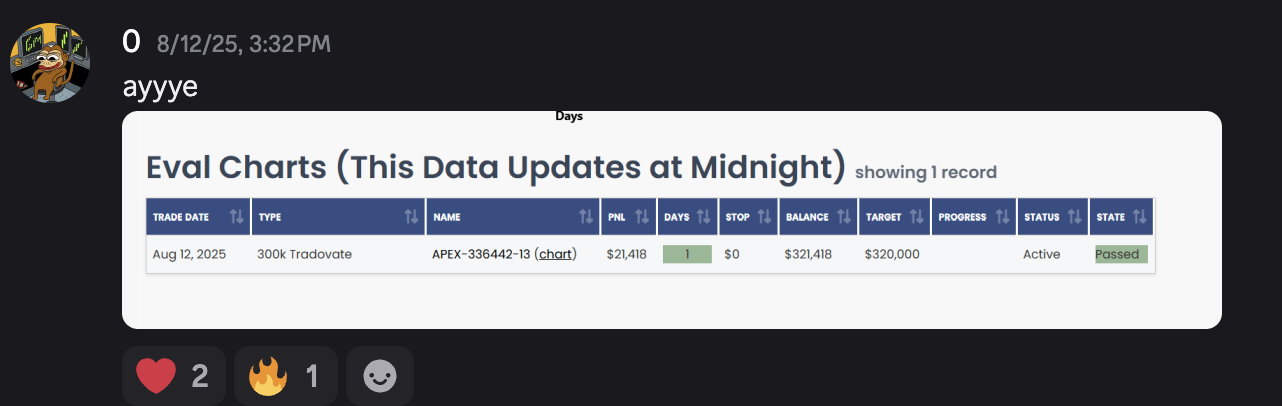

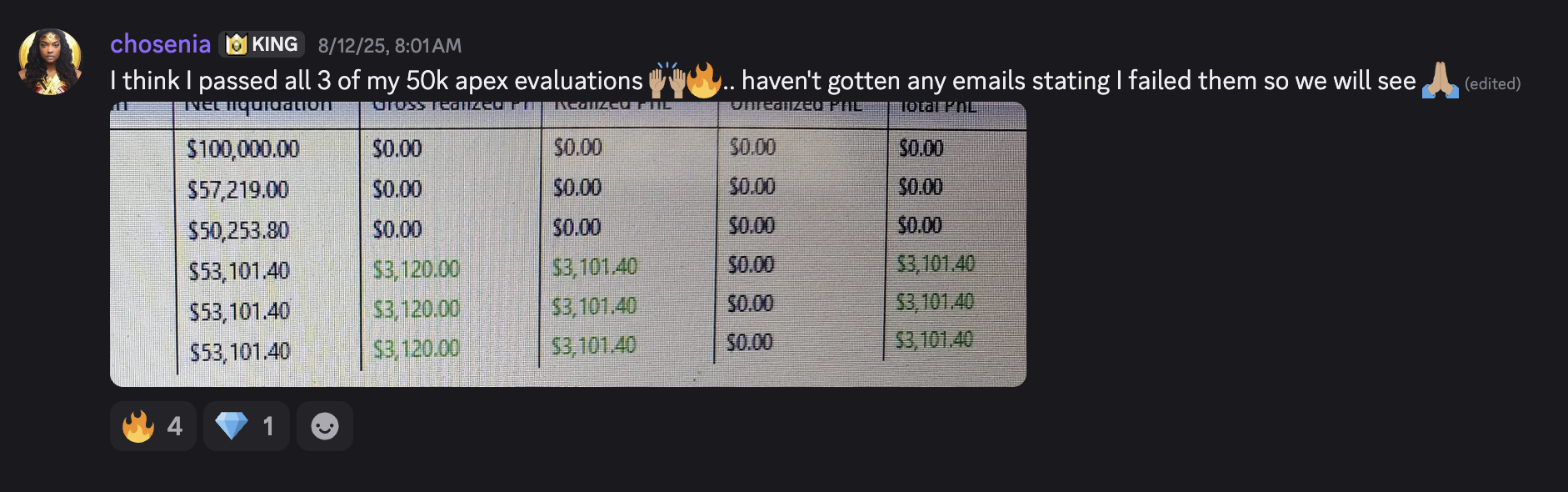

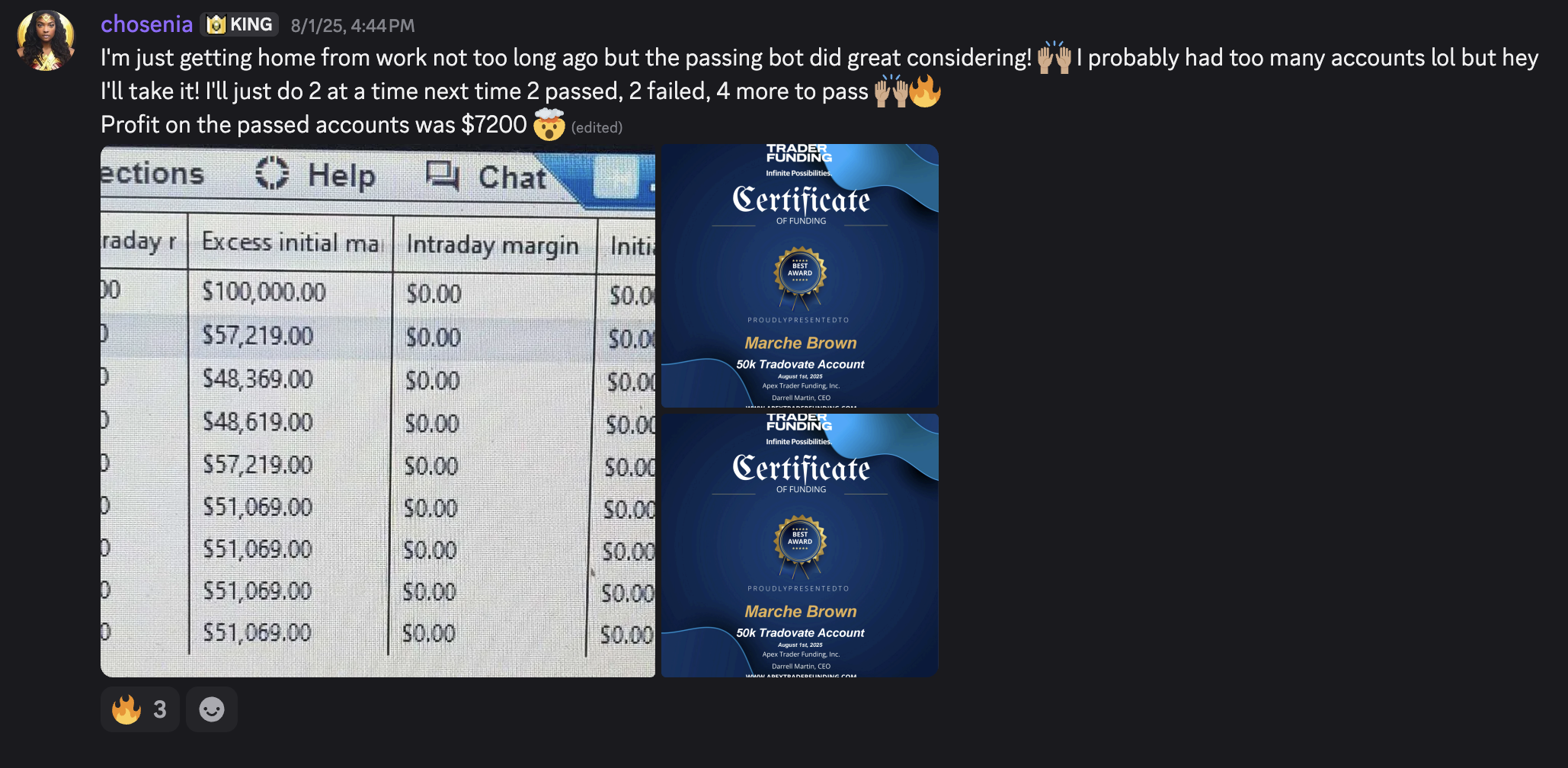

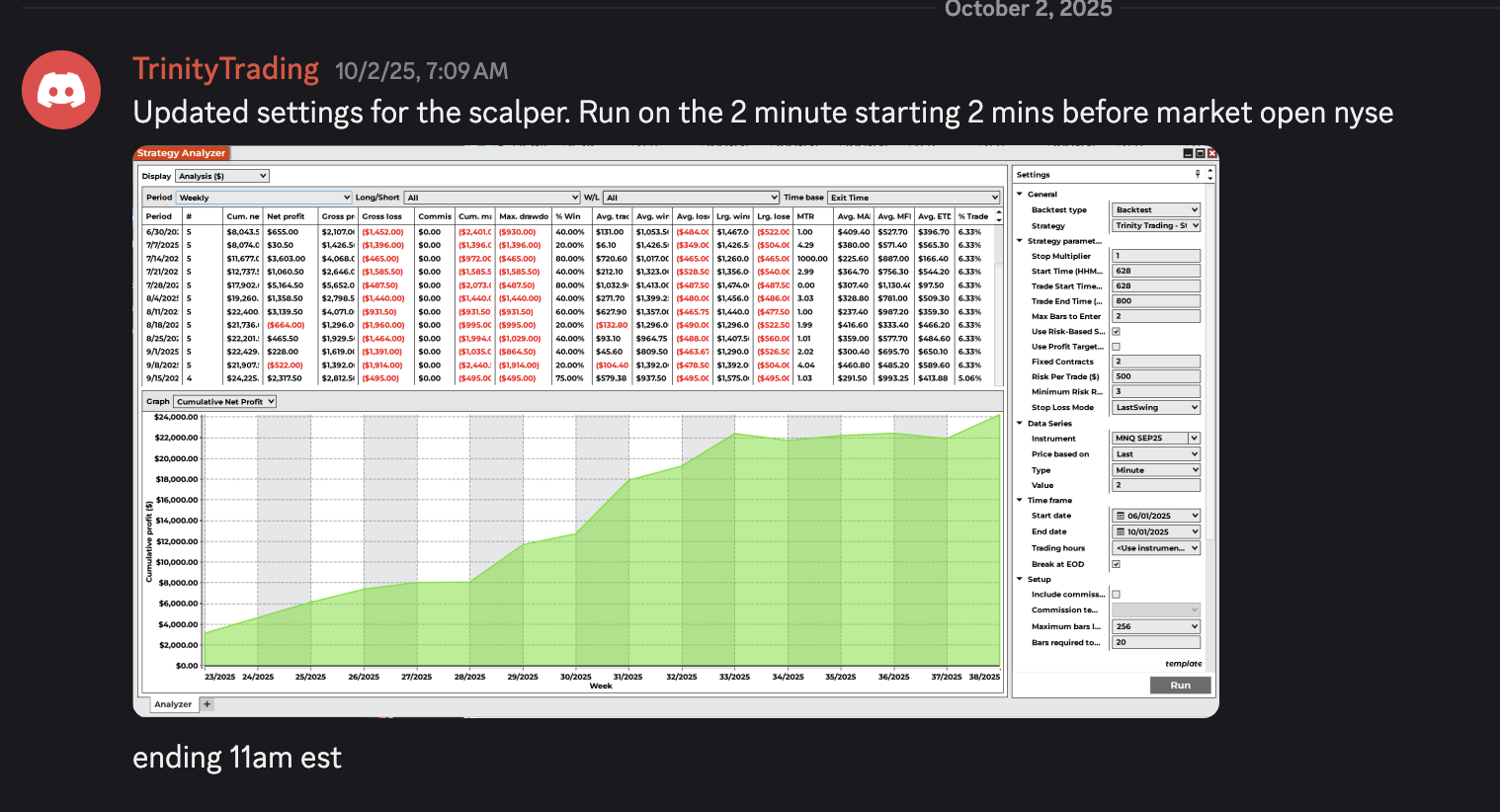

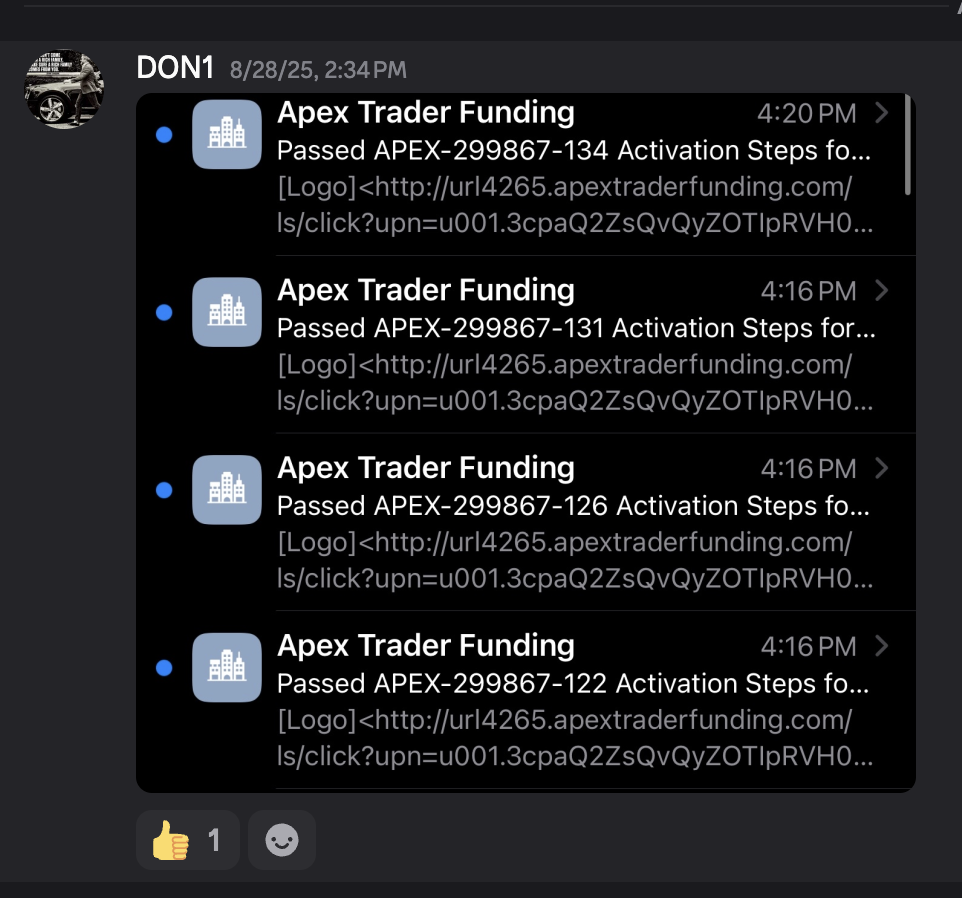

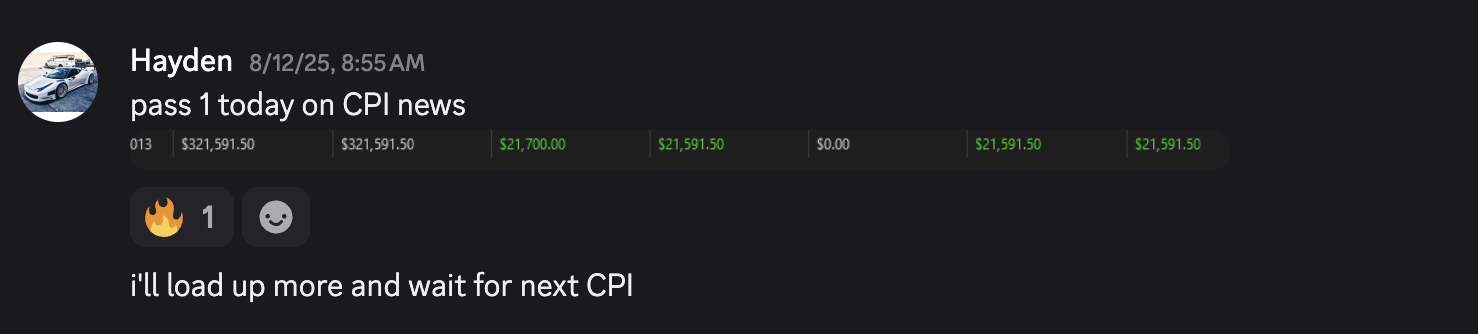

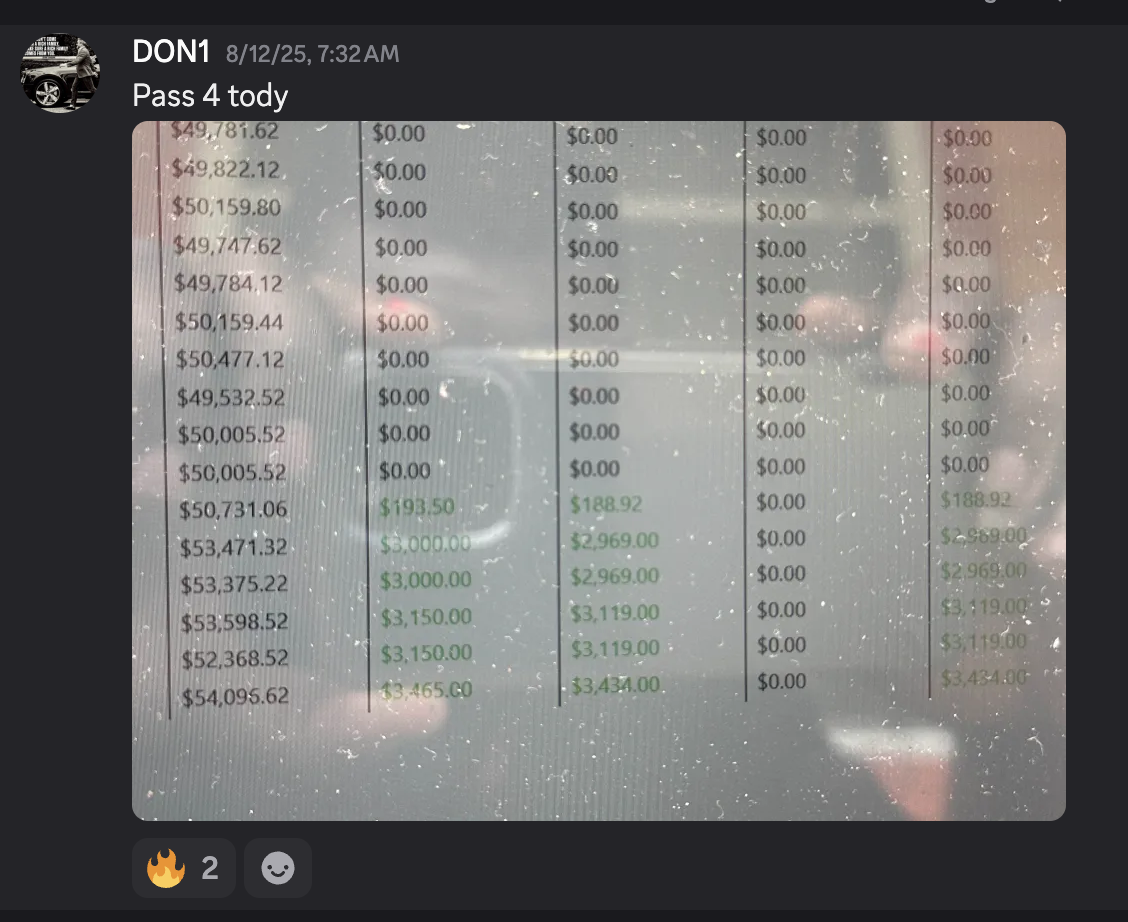

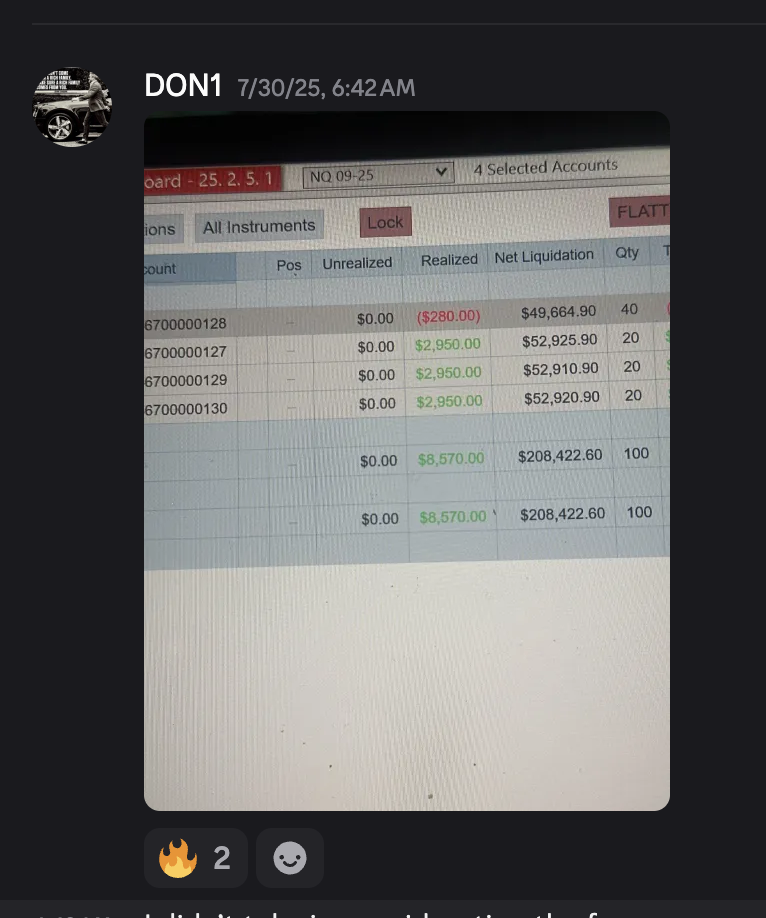

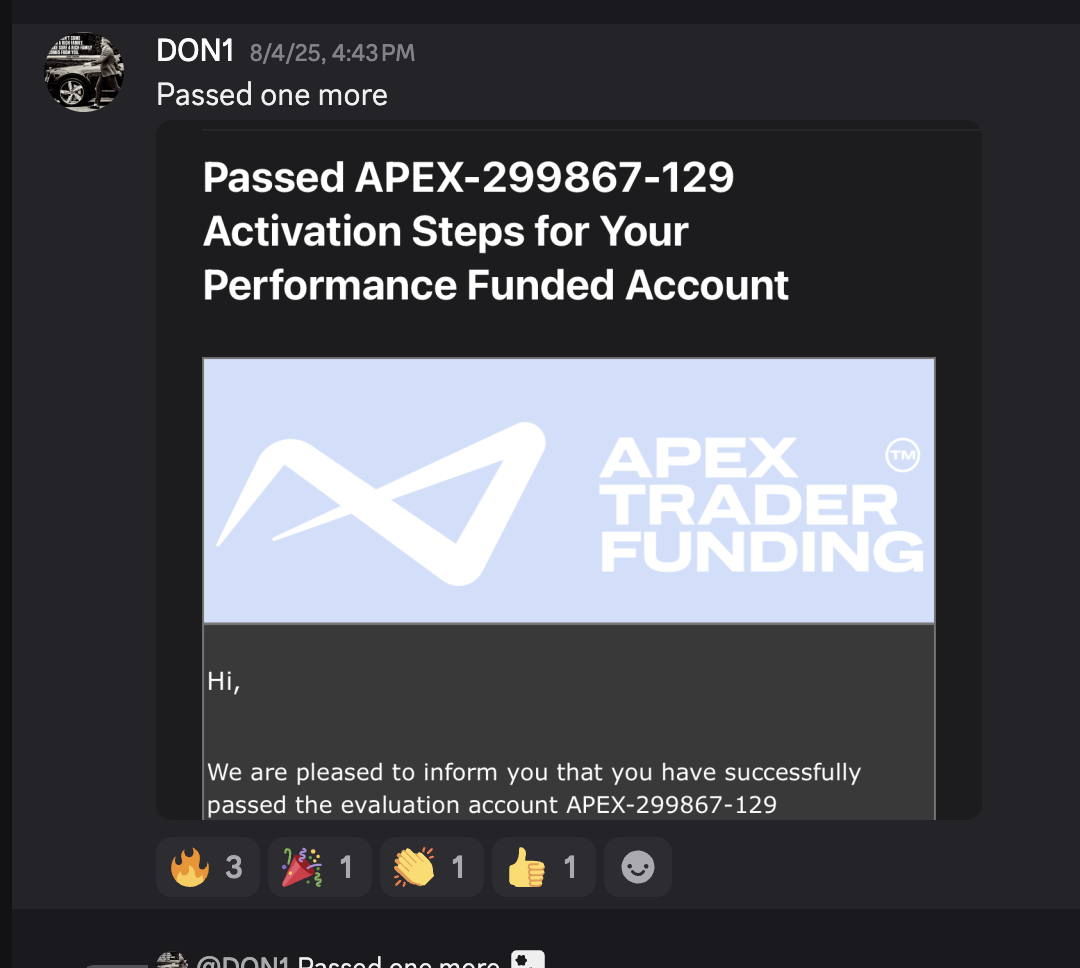

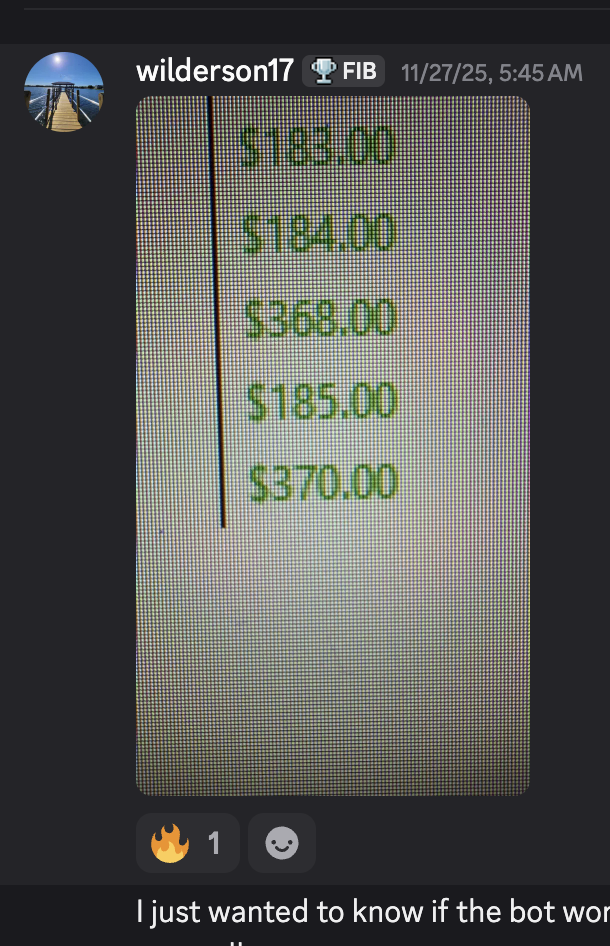

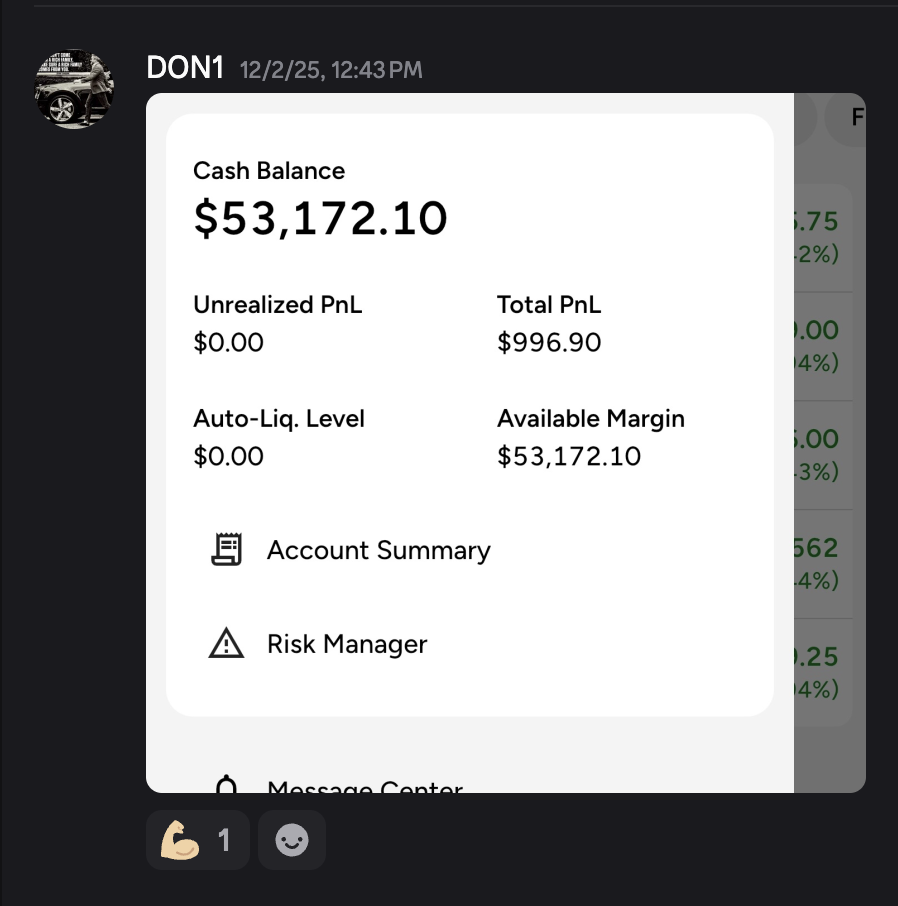

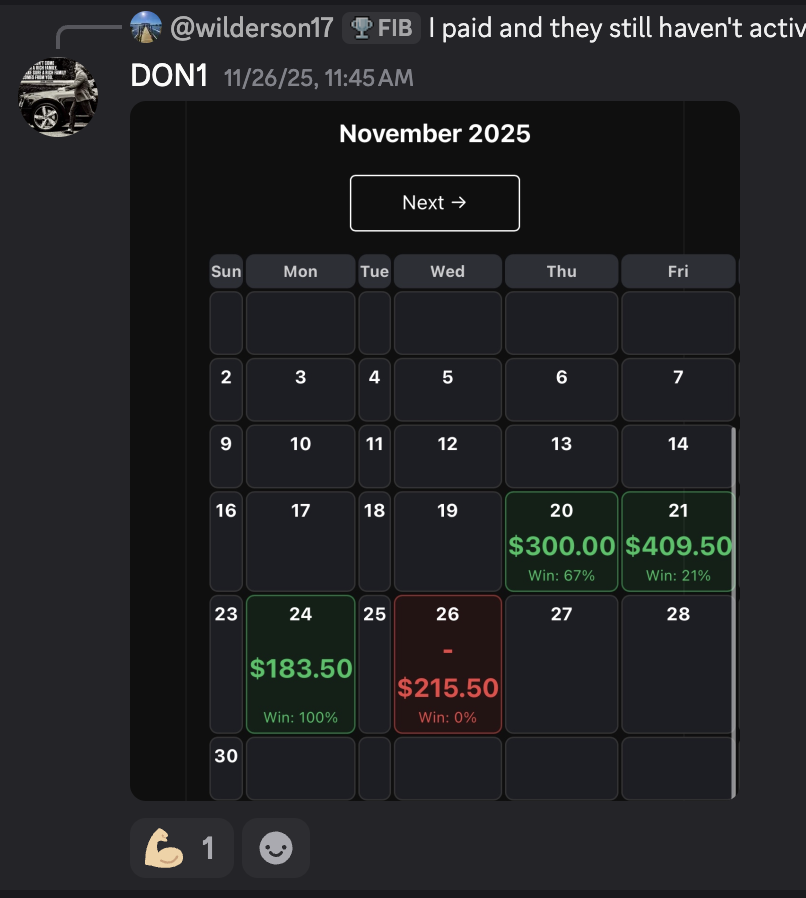

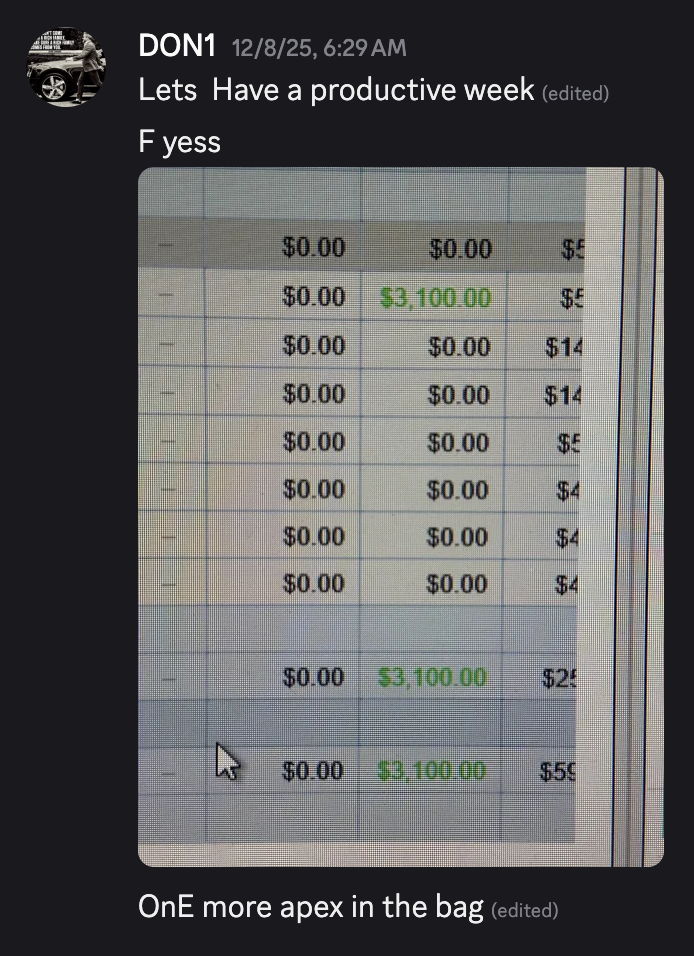

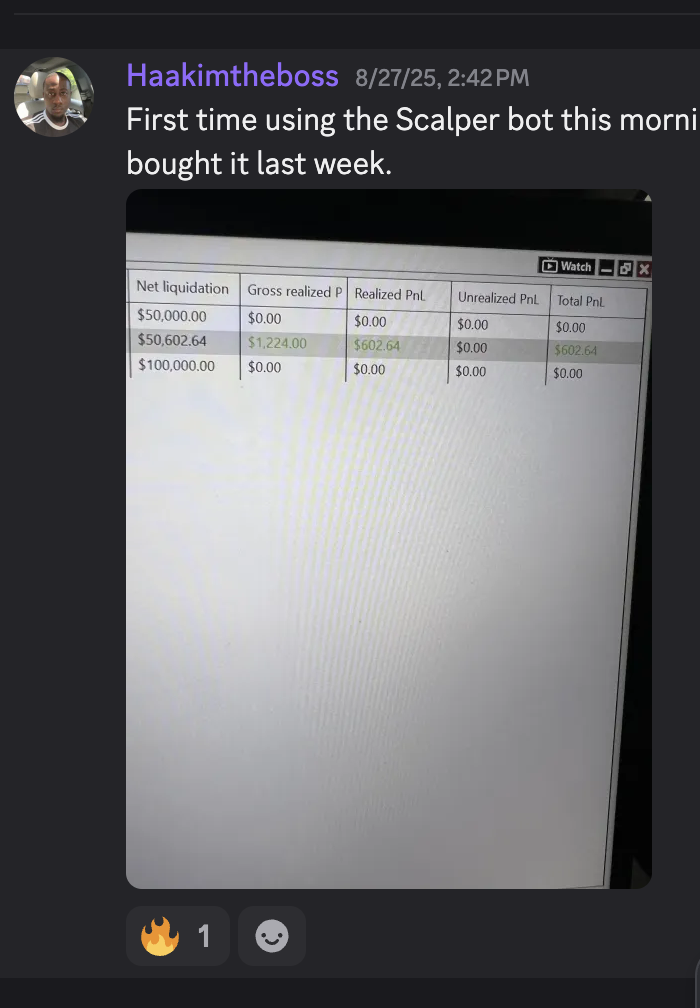

User Results Payouts • Passed Accounts • Consistency

A quick snapshot of what the community is sharing — payout certificates, funded growth, and clean rule-following. Results vary. Trading involves risk.

i was honestly just tired of staring at charts and then doing something dumb lol. the 1 trade cap helps. i stopped “making it back” and my dd has been way cleaner.

setup was easier than i thought. the “looks scary” part is real but it took like 10 min. i run micros only. i like that it flattens end of day so i dont get wrecked overnight.

ngl i was skeptical cause “bots” usually mean martingale stuff. this isnt that. it waits, takes the trade, and thats it. i dont feel glued to the screen anymore.

my issue was always rules. id be up and then break the daily loss like an idiot. this keeps me from clicking buttons. its boring in a good way.

passed my eval faster than when i was manual. not like “overnight” but steady. also the trailing dd is less stressful when im not overtrading.

support answered my dumb questions w/out making me feel dumb 😂. i had nt8 already but never installed anything. machine id thing was quick.

i kept blowing evals because id take 4-7 trades trying to “force it”. this basically removed that option. less trades, less problems.

im not a “system hopper” anymore lol. i just wanted something consistent. its not perfect everyday obv, but my worst days are smaller now.

big thing for me: it stops at end of day. i used to hold and then wake up to chaos. now its just… done. sleep is better.

i still watch sometimes but i dont “interfere” now. thats the whole point. i used to mess with stops and make it worse.

the market is already hard enough. i like not having 10 indicators yelling at me. execution is the only thing i needed to fix tbh.

i had a “reset button” problem 😅. this slowed me down. not in a bad way. just less impulsive. my equity curve is smoother.

One trade a day.

ICT-inspired entries.

Built for prop rules.

StealthScalp runs on NinjaTrader 8 and connects through Tradovate, Rithmic, or CQG. It targets the first high-quality setup of the day using Fair Value Gaps and session timing — with static dollar risk and a fixed R:R target.

- Runs in NinjaTrader 8 (strategy on chart)

- Connects to Tradovate (also Rithmic/CQG)

- ICT-inspired FVG logic + session timing filters

- One trade per day (prevents overtrading)

- Auto close end of day (avoids overnight issues)

- 1 Define session/range window

- 2 Wait for liquidity sweep (range high/low)

- 3 Confirm MSS (structure shift)

- 4 Enter via FVG midpoint rule

- 5 Static $ stop + fixed R:R target

- 1 Install NinjaTrader 8

- 2 Import the strategy file

- 3 Restart NinjaTrader

- 4 Send Machine ID for activation

- 5 Apply recommended settings

Automated futures trading.

Built for prop firms.

A NinjaTrader 8 strategy engineered around structure, discipline, and rule-safe execution — not randomness.

Launch StealthScalp today.

Built on NinjaTrader 8 with a rules-first mindset: session controls, strict risk logic, and clean execution designed for prop-style constraints.